A major political saga of 2019 is going to be the fate of Senate President Steve Sweeney "Path to Progress" tax savings recommendations.

Sweeney's task force differs from many previous attempts to address property taxes in New Jersey by making an assumption that NJ has a spending problem, not a revenue problem, and therefore makes 40 recommendations to help rein in state and local spending in New Jersey.

One of "Path to Progress's" recommendation that I'll address here is the recommendation to consolidate all non-K-12 districts into K-12 districts.

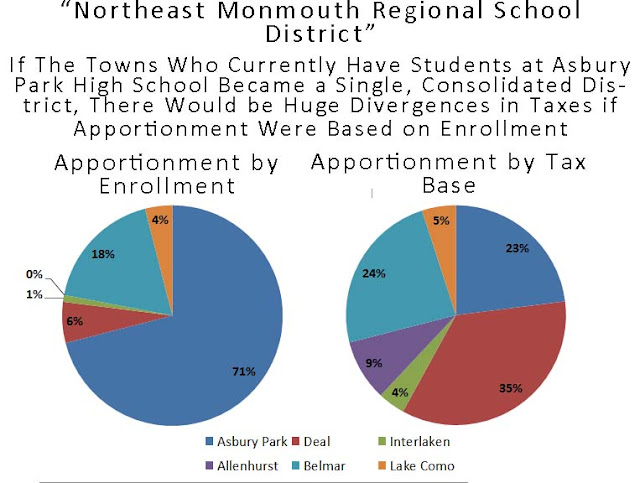

This blog post will then identify the complexities that will arise in tax apportionment in newly-consolidated districts and why taxation must be apportioned by Equalized Valuation and not student enrollment.

As NJ State Senator Vin Gopal writes:

Although K-12 districts educate 71% of NJ's students, they are actually just 22% of NJ's geographically-defined districts. (NJ non-geographically defined districts are charter schools, special education districts, and vo-techs.)

One of "Path to Progress's" recommendation that I'll address here is the recommendation to consolidate all non-K-12 districts into K-12 districts.

This blog post will then identify the complexities that will arise in tax apportionment in newly-consolidated districts and why taxation must be apportioned by Equalized Valuation and not student enrollment.

---- The Consolidation Recommendation ----

As NJ State Senator Vin Gopal writes:

One of the smartest ways to provide property tax savings is to regionalize services where we can save tax dollars while providing equal or better service.

Let�s start with school regionalization. On average, more than 50 percent of every property tax bill goes into funding education from preschool to 12th grade. New Jersey students score second only to Massachusetts on national standardized exams, and the quality of our schools is one of our best selling points as a state.

But we can do better and at a lower cost. Too often, our K-4, K-6 and K-8 school districts do not coordinate curriculum or teaching methods, textbooks or specialized services with the regional high school districts their children will be attending, so 7th and 9th graders arrive with different skill sets.

Furthermore, a recent analysis showed that the 120 K-4 to K-8 school districts with 480 or fewer students spent 17 percent more on average � about $3,400 per child � than the 360 districts with more than 1,000 students.

Clearly, it makes sense on both an educational and a cost basis to move forward with K-12 regionalization plans that will create larger districts with the more diverse curriculum that students need heading into high school while saving on duplicative administrative and back-office operations.

----Background on Enrollment and Taxes----

Although K-12 districts educate 71% of NJ's students, they are actually just 22% of NJ's geographically-defined districts. (NJ non-geographically defined districts are charter schools, special education districts, and vo-techs.)

- K-6, 56 districts, 12% of the total districts, but only 32,410 students, or 3.1% of enrollment.

- K-8, 222 districts, 47% of the total, but only 179,473 students, or 17.2% of enrollment.

- 7-12 and 9-12, 64 districts, 14% of the total, but only 90,235 students, 8.7% of enrollment.

- K-12, 131 districts, 28% of the total, but 740,311 students, 71% of enrollment.

Of the sixty districts in NJ with the highest tax bases per student, 42 are K-6 or K-8 districts.

So, Sen. Vin Gopal's statement about high spending is slightly incomplete about the causation of high average spending in small districts because many K-6s and K-8s are extremely rich in tax base and they skew the spending average higher. Avalon Boro alone is an outlier and skews the spending of K-8s higher.

---- To Apportion Taxes By Enrollment or Tax Base, That is the Question ----

Because there will be situations where K-6 and K-8 districts will be merged with districts who are much less wealthy or more wealthy than they are, a battle will arise on how taxes are to be apportioned.

- If taxes are apportioned by enrollment -- so that a town that contributes 15% of the students pays 15% of the costs even if it does not possess 15% of the tax base -- then there will be divergences in tax rate between the towns.

- If taxes are apportioned by Equalized Valuation -- so that a town that has 15% of the tax base pays 15% of the costs -- then tax rates between the towns will be equal, although per pupil costs will diverge.

Since Asbury Park has 71% of the students at this consolidated district, it would have to pay 71% of the costs, which is triple its share of the tax base.

Deal, which has 35% of the combined tax base, would pay merely 6% of the costs to match its 6% of the total enrollment.

Mathematically, Asbury Park's tax rate would be 18x what Deal's is if taxes are based on enrollment.

If taxes are based on enrollment, then the tax bases of Deal, Allenhurst, Interlaken, and to a lesser extent Belmar and Lake Como would effectively be "walled off" from being tapped and the tax base would appear artificially low in the eyes of SFRA. The State of New Jersey would then have to deliver unneeded Equalization Aid. Apportioning taxes by enrollment would thus make a mockery out of SFRA since the Equalized Valuations of towns with high tax base:enrollment ratios would be untouchable by the consolidated school districts.

BY CONTRAST, under tax apportionment by Equalized Valuation, every district would have an equal tax rate, although taxes per student would be very high and Deal, Interlaken, and Allenhurst. They would probably end up paying over $100,000 per student they actually send to the new district.

Many people living in Deal, Interlaken, and Allenhurst would argue that that is "unfair" to make them pay more per student than less-wealthy towns, but is it "unfair" if the taxpayers in a wealthy section of a town pay more per student than the taxpayers in a poor section? Is it unfair if the owners of a $600,000 house pay more per student than the owners of a $400,000 house?

If taxes were apportioned by enrollment, a family living in Asbury Park would pay thousands of dollars more per year in property taxes than a family living in a property of identical value in another town. Since the tax rates would vary so much, even houses worth $100,000 in Asbury Park would pay more in school taxes than $1+ million houses in Deal, Interlaken, and Allenhurst.

The phenomenon of staggeringly unequal tax rates already happens in Manchester Regional High School in Passaic County, where North Haledon, Prospect Park, and Haledon have a unique hybrid tax apportionment formula that is based 50% on Equalized Valuation and 50% on enrollment.

Although North Haledon has 60% of the three towns' tax base, it only pays 21% of the taxes. Conversely, Prospect Park has only 14% of the tax base, but it must pay 31% of the taxes.

See "Manchester Regional: NJ's Most Underaided and Divided School District"

If apportionment by student enrollment is duplicated in all consolidated districts, then inequality like will exist through New Jersey.

---- Conclusion ----

However, consolidation isn't something that will save every taxpayer money, even if school district administrative expenses decrease. If newly consolidated school districts apportion taxes by Equalized Valuation, which I see as the only fair way to have apportionment, then some towns that have walled off their tax bases behind "home home" independence are going to have to pay higher taxes (aka, their fair share).

Although towns who have high ratios of tax base:students will resist fighting their fair share and make this an uphill struggle, it's a battle to make sure that all New Jersey taxpayers have somewhat equal burdens for local education and therefore a battle worth fighting.

-----

See Also

- "Sussex County Consolidation"

- "Dream First, Figure Out the Costs Later: Paul Tractenberg's Idea for an Essez County Superdistrict"

- "Why Cape May Needs Consolidation, Not Permanent Adjustment Aid!"

So

No comments:

Post a Comment