Bergen? No!

Hudson? No!

Morris? No!

Hunterdon? No!

Answer: CAPE MAY.

BY FAR.

Yet, despite Cape May's exceptionally high wealth, Cape May school districts and politicians have been fighting not for an effective means of tapping their own tax base, but for more of the state's money, specifically, keeping Adjustment Aid permanent.

This post is an argument that what Cape May needs is district consolidation in order to be able to tax its wealthiest towns, not permanent Adjustment Aid.

---- Background ----

Wildwood's superintendent J. Kenyon Kummings, has been outspoken in favor of Adjustment Aid. He has called taking money from overaided districts and giving it to underaided districts a "shell game."

Writing in May 2018, Wildwood's superintendent said:

Last spring [in 2017], school districts received their state aid notices, approved their budgets and prepared for the 2017-18 school year. After finalizing their budgets, over 100 districts were told other districts needed more funding so some of their aid would be cut and sent to those other districts.

In effect, the state Legislature moved money around, creating winners and losers among our school children.....

Cutting our funding to give other districts more money, as happened last year, is not what our students, schools and communities need.

Public school educators have a professional responsibility to represent the needs of all students, not just in our own district, but across the state. We cannot support changes in the distribution of state aid that negatively impact some of our children at the expense of others.

We need to take a firm stand against a final state budget that moves money around from district to district again this year, pitting groups of districts against one another. Playing shell games does not help our students or their schools, regardless of whether one district may be owed more aid under the funding formula than another.

The good news is that Murphy and most legislators agree on the urgent need to reduce the deep deficit in school funding caused by the last eight years of neglect. But taking books out of one child's hands to place them into the hands of another is simply not the way forward.In that whole op-ed, Kummings says not one word about underaided districts and places all the blame on NJ's funding deficit on Chris Christie and says the problems only started eight years prior. Kummings even denies that receiving additional state aid is a "help" at all to a district receiving that aid. He never even comes close to saying what the "best way forward" even is, let alone how much it would cost or where NJ would get the money.

Wildwood Crest's boro administrator, Constance Mahon, claims that there isn't "anyone" who would claim any district in Cape May is overfunded:

"Ironically, I know of no school in this county that anyone would consider overfunded. Schools are struggling every day to provide the level of service and quality of education that our children deserve. This Robin Hood approach to school funding will create a financial dilemma for not only Wildwood Crest residents but a vast majority of our county residents."

Really, anyone?

Personally I know a lot of "anyones" who would say that some Cape May districts are overfunded/overaided, including myself, the authors of S2, and including the impersonal formulas School Funding Reform Act, which in 2018-19 says that sixteen Cape May districts are receiving more state aid than they need:

---- Cape May County is Rich ----

"Ironically," Constance Mahon concedes this a "Robin Hood approach," which would seem to acknowledge that some Cape May districts are rich, which indeed they are, with seven operating and the three non-operating Cape May districts having more than $30,000 per student in Local Fair Share.

Although Cape May's residential income is slightly below the median for NJ, Cape May has, by far, the highest tax base per student of any county in New Jersey, with nearly twice the Local Fair Share per student of Morris County, the next wealthiest county.

Cape May County's overall tax wealth per student is actually superior to that of New Jersey's richest independent suburbs, like Princeton, Millburn, and Mountain Lakes.

This extraordinary property wealth is due to Cape May County having many second-home properties and hotels.

Since the seventeen Cape May districts had a $161.8 total tax levy for 2017-18 and Cape May County's total Equalized Valuation is $51 billion, if Cape May County became a single, consolidated district it would only need a tax levy of 0.33%, which is one-quarter the state average!

---- The Budgetary Solution is Consolidation ----

Cape May County's problem is that its gargantuan tax-base assets are barricaded within a handful of small towns who have independent school districts and are thus not required to share their wealth with the rest of Cape May County's students. Several of these small, rich towns have "Send-Receive" relationships with larger, K-12 districts where they pay flat-rate per student tuition to the receiving districts, in which the total tuition is a minuscule portion of their tax capacity.

Indeed, Avalon has 15.3% of Cape May County's tax base, but only 0.26% students. Avalon's Equalized Valuation is larger than Cherry Hill's, but it has barely a classroom worth of residential students. Stone Harbor has 8.2% of Cape May County's tax base, but only 0.2% of the students. North Wildwood has 5.2% of the tax base, but 1.7% of the students.

Cape May Point and Sea Isle City also have huge tax bases relative to enrollment, but they are non-operating districts. Cape May Point has $457,833,090 in Equalized Valuation, and only four students. Sea Isle City has $4.8 billion in Equalized Valuation and 85 students.

Overall, Cape May's ten districts who have more than $30,000 in Local Fair Share per student possess 64% of Cape May's Local Fair Share ($251 million out of $391 million), but only 20% of the students (2,326 students out of 11,527)

Since Wildwood City has been aggressive in fighting to maintain its $2 million in Adjustment Aid, let's take a deeper look at the untapped tax bases of its own Send-Receive districts:

The

For J. Kenyon Kummings to fight to keep $2 million in Adjustment Aid, and not fight just as hard to get Wildwood's Send-

|

| Steve Sweeney Already Supports Consolidation that Would Benefit Wildwood City. He Just Needs Help from Wildwood City Itself. |

Kenyon Kummings might demur by saying that it is not politically viable for Wildwood City to get more taxes out of its Send-Receive districts, but that is changing, since the consolidation of non-K-12s into K-12s is part of Steve Sweeney's "Path to Progress."

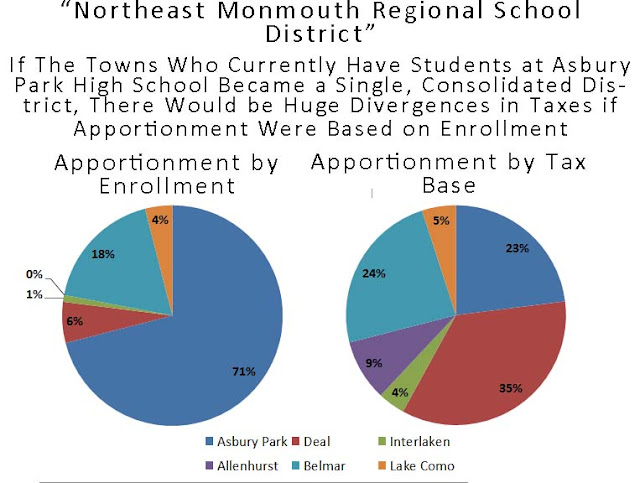

Cape May districts themselves have discussed consolidation, with the usual complaints from the rich beachfront districts that tax apportionment be based on student enrollment, so that they are treated "fairly."

For example, in 2012 Cape May City's deputy mayor bemoaned the fact that Cape May City was forced to pay the same tax rate as Lower Township because it meant that Cape May City spent more per student

'I�ve been talking about [tax apportionment] since the year 2000,' he said. 'It is so inequitable what�s happening to us.'

Wichterman said the $50,000 per student fee could send each student to Princeton.'We have no say in the formula that�s utilized to determine how much money we pay to that school district,' he said.

'There are several formulas that can be used and the one that the Lower Township members of that school board chose to use is the one that penalizes the City of Cape May because our real estate values are so much higher than they are in Lower Township.'

But why should "equity" be measured according to how much money a town spends per student?

NJ's towns are artificial political entities with arbitrary borders. No one claims that a district's wealthiest neighborhood is "penalized" when it contributes more per student in taxes than poorer neighborhoods. Few families that live in expensive houses don't say they are "penalized" for paying they will pay more per student than the owners of less expensive houses.

Even conservatives who advocate for a flat income tax acknowledge that wealthier people should pay taxes that are out-of-proportion to the services they receive.

So why would it be any different for property owners in a section of Cape May called "Avalon" or "Sea Isle City" "Wildwood Crest" or "Cape May City" to pay more per student than property owners in other sections called "Wildwood City," "Dennis Township," "Lower Township," or "Woodbine"?

Even if Adjustment Aid were not going to be phased-out, it would behoove Cape May County to consolidate because its K-12 student enrollment has been falling for years, falling from 13,800 in 2007-08 to only 11,743 in 2017-18. As Cape May's births per year is down by 15% since 2000,it seems likely that that enrollment decline will continue indefinitely.

It would also behoove most year-round Cape May residents to seek consolidation because their taxes would actually fall as all districts converged on the 0.33% countywide tax average. As Avalon, Stone Harbor, pay more, Dennis Township, Wildwood City, Lower Township, and Upper Township will pay less.

----

See Also:

- "NJ District Consolidation and Tax Apportionment"

- "Sussex County Consolidation"

- "Dream First, Figure Out the Costs Later: Paul Tractenberg's Idea for an Essez County Superdistrict"