There are many ways to assess the a location's business climate, such as quality of workforce, quality of life, quality of transportation, access to capital, cost of living, proximity to professional services, litigation exposure, labor laws, and yes, tax rates.

There are many groups who try to rank states by "Business Climate." CNBC has a very broad based ranking that depends, in part, on economic growth itself. US News's ranking relies entirely on innovation and entrepreneurship. Forbes's ranking goes by low costs for things like energy and labor, lax regulations, and then "quality of life" thrown in too. The Tax Foundation, for its part, has a ranking entirely focused on tax rates.

New Jersey does terribly in the Tax Foundation ranking, coming in 50th place (dead last) for several years in a row.

Jon Whiten, Vice President of the New Jersey Policy Perspective and NJ's most prolific economics commentator, doesn't dispute that NJ's taxes are indeed comparatively high, but he claims that low taxes can't be identified with "good business climate" and our high taxes aren't hurting the state.

To construct an argument that New Jersey's taxes aren't damaging the state and taxes can go even higher, Whiten points out that 21 Fortune 500 companies are headquartered in NJ. He adds that Fortune 500 headquarters are concentrated in other high-tax states too and that they are relatively absent from the lowest-tax states.

In sum, Whiten says that the presence of 21 Fortune 500 companies here proves that "High-Tax States Are Great Places to Do Business."

The latest update to the annual Fortune 500 list of the largest American companies was released this week, and 21 Garden State businesses made the list. It�s an impressive showing for a state that usually falls to the bottom of misleading national rankings that claim to measure how attractive different states are to business investment. In fact, most of these so-called �studies� are promoted by organizations that are not advocating for a truly stronger business climate but only for lower corporate taxes.

Perhaps the most popular of these rankings is the Tax Foundation�s annual �Business Tax Climate� index. Business lobbying groups in New Jersey and anti-tax lawmakers frequently cite New Jersey�s perennial dismal ranking on this survey as proof that the Garden State�s taxes are stifling business investment and creating a drag on economic growth.

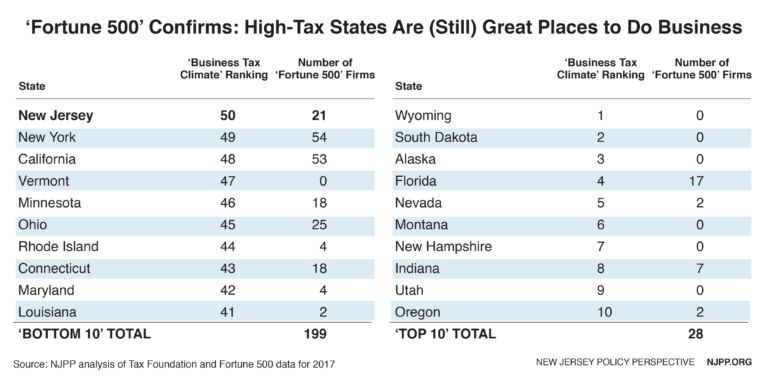

But an interesting trend emerges when one cross-references the Fortune 500 with the �Business Tax Climate� index: The �worst� states in the Tax Foundation�s index have a disproportionate share of America�s largest corporations, while the �best� states hardly have any. ...

In fact, not a single state that ranks in the top 10 of the Tax Foundation�s index has more Fortune 500 companies than New Jersey, which ranks dead last in the index. And the entiretop 10 states, with just 28 Fortune 500 companies, barely have more of these big businesses than the Garden State alone. [Whiten's emphasis]And then Whiten provides:

While I don't think that tax rates are the end-all-be-all of business climate, neither are they unimportant, and I do see NJ's high taxes creating drag on the economy. The fact that New Jersey has 21 Fortune 500 headquarters is interesting, but not important when it comes to the real measures of health of our economy.

If having Fortune 500 Headquarters Vindicates High-Tax Economics, What Does Their Absence from South Jersey and Central Jersey Mean?

As Whiten says, is tied for sixth place with Pennsylvania for having the most Fortune 500 companies, after New York (54), Texas (54), California (53), Illinois (36), Ohio (25), and then Virginia (22).

But even if you agree with Whiten and you believe that the presence of Fortune 500 companies vindicates high-tax economics, the distribution of New Jersey Fortune 500 companies exposes NJ's economic weaknesses as well, as well as undermines the NJPP's constant denunciation of tax incentives.

Of the 21 Fortune 500 companies in NJ, all but four are in northern NJ.

Central Jersey has exactly two Fortune 500 headquarters, NRG Energy (actually a co-headquarters) and Johnson & Johnson. South Jersey has two small ones, Burlington Stores and Campbell's.

There is contrast between the Pennsylvania-side suburbs of Philly and NJ-side suburbs. The PA suburbs have seven Fortune 500 companies and Allentown has another two.

Proximity to New York City might be an asset that companies will tolerate high taxes to have, but the farther away a location is from New York City, the less tolerant businesses are of NJ's tax premium. The tax rates that Whiten defends do unequal damage to NJ; the parts near New York are less vulnerable than outlying regions.

States are artificial entities and the presence of Fortune 500 headquarters means anything, it means something for the five counties in North Jersey alone that host 19 of them, not the entire state.

Job Gains Count

But I think counting Fortune 500 companies misses the forest for the trees because most job creation takes place in small businesses, subsidiaries, US branches of multinational companies, back offices, and the headquarters of big businesses that are below the Fortune 500 cutoff.

Even headquarters themselves do not necessarily have many employees. Only nine of the 21 Fortune 500 companies in New Jersey even appear among New Jersey's 100 largest employers and that includes retailers like Bed Bad & Beyond and Toys 'R' Us and service employees at Quest Diagnostics. NJ's biggest company is Johnson & Johnson, but J&J is down to 9,600 New Jersey employees out of 127,000 worldwide.

If you look at comparative jobs gains from the start of this decade, the lowest-taxed states have done better, so the contention that high taxes are "stifling business investment and creating a drag on economic growth" doesn't seem to be invalidated to me no matter how many Fortune 500 company headquarters high-tax states have.

From Q1 of 2010 to Q1 of 2017:

|

| Source, https://www.bls.gov/cew/datatoc.htm. Jobs include public sector + private sector. Note, WY, AK, and LA are affected by swings in energy markets. |

New Jersey actually does even worse if you look at business creation than it does in overall job gains. According to the Bureau of Labor Statistics's "Establishment Count," New Jersey only gained 2,260 private-sector businesses from 2010 to 2017 (264,287 to 266,547), or 0.9%. The US gained 10.9%.

The salary of jobs counts as well, and here NJ does terribly. According to Richard Hughes of the Bloustein School at Rutgers, since the Great Recession NJ has approximately 100,000 fewer jobs paying above-average wages and 135,000 more jobs paying below-average wages.

That's great that Jon Whiten thinks New Jersey is still a "great place to do business" despite its high taxes, but real businesses aren't convinced and there are fewer well-paying jobs here than in the past.

Of course the fastest growing states listed here have advantages other than low-taxes, like lower costs-of-living for non-tax expenses, warmer weather, and right-to-work, but the lack of Fortune 500 headquarters seems to not reflect meaningfully on their economic health, nor does the presence of Fortune 500 headquarters reflect health for New Jersey.

Utah's economy grows by over 3% a year, but it has zero (0) Fortune 500 headquarters. Utah's economy thrives in nearly everything, including high-salary fields like technology and finance. I doubt the lack of a Fortune 500 headquarters matters to many people there.

Likewise, I don't think that New York State's 54 Fortune 500 headquarters matters to anyone living in Buffalo, since New York City is a world away from that part of New York. While Upstate New York might be part of the same state as dynamic, booming New York City Upstate New York suffers from significant economic erosion and population loss.

Despite it having the high taxes that Whiten believes lead to growth, Upstate New York is in permanent decline. Depending on the year, Upstate New York only has 2-4 Fortune 500 headquarters (Corning, Constellation Brands, newcomer Wegman's, and M&T Bank off-and-on).

If Upstate New York were an independent state, it would have fewer Fortune 500 companies than any other state bordering the Great Lakes.

The Disproportionality is Partly a Coincidence

Whiten is factually correct that NJ and the nine other highest-tax states have dramatically more Fortune 500 headquarters than the ten lowest-taxed states, but then again, this is something you would expect based on the fact that the highest-taxed states's population is 240% as large (102 million versus 42 million) as the lowest-taxed states. On a per capita basis there is still a disproportionality, but not as wide as the raw-numbers comparison that Whiten uses.

This trend of the ten highest taxed states having a lot more Fortune 500 companies than the ten lowest taxed states is also partly a coincidence created by the Tax Foundation's rankings, because if you look at the next five highest-taxed states and the next five lowest-taxed states, the next five-lowest taxed states have more headquarters than the next five highest-taxed states.

So the next five highest taxed states only have 37 Fortune 500 companies, but the next five lowest taxed states have 106. To be sure, the fifteen highest taxed states still have more Fortune 500 companies (236) than the 15 lowest taxed states (134), but the gap isn't nearly as wide as between the highest-taxed ten and lowest-taxed ten.

Whiten "Don't even think of cutting taxes!"

Whiten closes his argument with a warning against tax decreases.

The bottom line: Despite the drumbeat of anti-tax groups and politicians, there is a long list of factors � like location, workforce, quality of life and more � that are far more important to most businesses than low taxes. And in a cruel and ironic twist, the more our elected leaders travel down the tax-cutting path, the less money there is to ensure the state is nurturing these far more important assets.There's a lot to unpack here, but a state can have a good location, good workforce, and a good quality of life without having high taxes.

Location is completely independent from taxes, since states are immobile parts of the North American continent. Raising taxes would not "nurture this important asset" since New Jersey is immoveable.

Contra Whiten, what is mobile is a workforce. Hence the thousands of New Jerseyans, Illinoisians, Upstate New Yorkers, and Connecticutians who leave every year to get jobs or retire elsewhere.

Of course quality of life counts, but for many workers, quality of life includes the ability to save money for retirement and children's educations, which are better met in lower-taxed states.

The thing that Whiten doesn't like to explain is how New Jersey can already have good schools, already have a good location, already have a highly-educated workforce and yet still have decades of economic underperformance behind it.

Whiten would probably blame our problems on Christie's neglect of NJTransit, but the parts of New Jersey that are doing the worst - like South Jersey and northwestern New Jersey - don't have train service into New York as it is and New Jersey's economy lagged the nation in the McGreevey-Codey-Corzine years too.

I agree that NJ is hurt by a high non-tax cost of living and I think Pennsylvania's own stagnation is evidence that taxes aren't the end-all-be-all of business climate, but I find it hard to believe based on NJ's recent economy history, polls of business owners about taxes, and my own anger at our sky-high taxes, that taxes aren't stifling economic growth in this state.

----See Also:

- NJ Lags the Nation in Every Economic Sector

- New Jersey and Its Neighbors's Job Growth, County by County

- The Economy and Abbott, What the NJPP Missed in New Jersey's Fiscal Disaster

No comments:

Post a Comment